2

The Fundamental Value of Stocks and Bonds

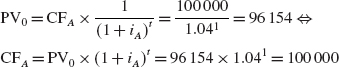

The fundamental value of an investment is the present value PV0 of its expected, future cash flows. Given a risk-free rate of 4%, an investment A that pays a cash flow (CFA of USD 100 000 at the end of one period with certainty is worth USD 96 154 today as an investor receives USD 100 000 at the end of one period if he/she invests USD 96 154 today at a risk-free rate of 4%:

If investment A currently traded below its fundamental value of USD 96 154 – for example, at USD 90 000 – an arbitrageur could borrow USD 90 000 at 4%, invest it in investment A and realize a risk-less profit of USD 6400 before transaction costs at maturity [USD 100 000 − 90 000 × 1 .04]. If investment A traded above its fundamental value – for example, at USD 105 000 – an arbitrageur could borrow investment A at a small borrowing fee from the owner of the asset, sell it for USD 105 000 in the market and invest the proceeds of the short sale at the risk-free rate. At maturity the investor would realize a risk-free profit of USD 9200 before borrowing fees and transaction costs [USD 105 000 × 1 .04 − USD 100 000]. As a result of these arbitrage transactions, the price of the asset which trades below its fundamental value would increase and the price of the asset which trades above its fundamental value would fall until all arbitrage opportunities are eliminated and the ...

Get Equity Valuation: Models from Leading Investment Banks now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.