Chapter 7The Liquidity Premium

Unpublished memorandum, 1979

Let the price ![]() at time u of a discount bond maturing at time v be described by the stochastic differential equation

at time u of a discount bond maturing at time v be described by the stochastic differential equation

where ![]() is a Wiener process. As shown in Vasicek (1977) (Chapter 6 of this volume), the mean

is a Wiener process. As shown in Vasicek (1977) (Chapter 6 of this volume), the mean ![]() and volatility σ(u, v) of the instantaneous rate of return are related by

and volatility σ(u, v) of the instantaneous rate of return are related by

where ![]() is the spot rate and

is the spot rate and ![]() is the market price of risk. Eq. (1) can be written as

is the market price of risk. Eq. (1) can be written as

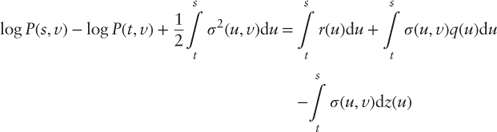

Integrate Eq. (3) over u from t to ![]() . We get

. We get

Now differentiate ...

Get Finance, Economics, and Mathematics now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.