PROBLEMS

REAL DATA

P5–1

Computing and interpreting ratios

Imation, a global technology company, reported the following selected items as part of its 2008 annual report (dollars in millions):

REQUIRED:

Compute the following ratios:

- Current ratio

- Quick ratio

- Receivable turnover (time and days)

- Interest coverage

- Return on assets

- Inventory turnover (times and days)

- Return on equity

P5–2

Borrow or issue equity: effects on financial ratios

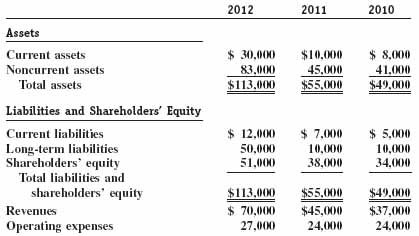

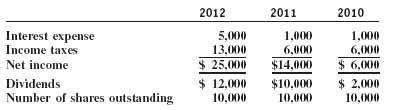

Edgemont Repairs began operations on January 1, 2010. The 2010, 2011, and 2012 financial statements follow:

On January 1, 2012, the company expanded operations by taking out a $40,000 long-term loan at a 10 percent annual interest rate.

REQUIRED:

a. Compute return on equity, return on assets, common equity leverage, capital structure leverage, profit margin, and asset turnover.

b. On January 1, 2012, the company's common stock was selling for $20 per share. Assume that Edgemont issued 2,000 shares of stock, instead of borrowing the $40,000, to raise the cash needed to pay for the January 1 expansion. Recompute the ratios in (a) for 2012. Ignore any tax effects.

c. Should the company have issued the equity instead of borrowing the funds? Explain.

REAL ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.