LONG-LIVED ASSET ACCOUNTING: GENERAL ISSUES AND FINANCIAL STATEMENT EFFECTS

The matching principle states that efforts (expenses) should be matched against benefits (revenues) in the period when the benefits are recognized. The cost of acquiring a long-lived asset, which is expected to generate revenues in future periods, is, therefore, capitalized in the period of acquisition. As the revenues associated with the long-lived asset are recognized, these costs are amortized with a periodic adjusting journal entry. Stated another way, since expenses represent the costs of assets consumed in conducting business, at the end of each accounting period an entry is recorded to reflect the expense associated with the portion of the long-lived asset consumed during that period.

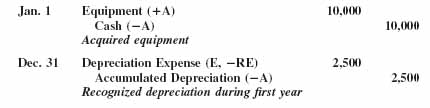

The form of journal entries to capitalize and amortize a piece of equipment follows. Assume that the equipment is purchased on January 1 for $10,000, and its cost is amortized evenly over its four-year useful life. Recall that amortization of a fixed asset is called depreciation and that the dollar amount of the depreciation expense recognized each year is accumulated in an accumulated depreciation account.

![]() Both Target Corporation and Carrefour, a giant French retailer that uses IFRS, report large depreciation add-backs ...

Both Target Corporation and Carrefour, a giant French retailer that uses IFRS, report large depreciation add-backs ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.