EXERCISES

E11-1

Disclosing debt and debt covenants

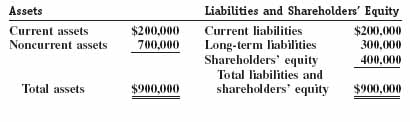

The balance sheet as of December 31, 2011, for Melrose Enterprises follows:

During 2011 Melrose entered into a loan agreement that required the company to maintain a debt/equity ratio of less than 2:1.

a. How much additional debt can Melrose take on before it violates the terms of the loan agreement?

b. Assume that during 2012 Melrose had revenues of $950,000 and expenses of $800,000. Assume that all revenues and expenses were in cash. How much additional debt can Melrose take on before it violates the terms of the loan agreement?

c. Assume again that during 2012 Melrose has cash revenues of $950,000 and cash expenses of $800,000. If Melrose pays a cash dividend of $100,000, how much additional debt can it take on before violating the terms of the loan agreement? If Melrose declares, but does not pay, the dividend during 2012, does it make a difference in the amount of additional debt the company can take on?

E11-2

Annual or semiannual interest payments?

Hathaway Manufacturing issued long-term debt on January 1, 2011. The debt has a face value of $300,000 and an annual stated interest rate of 10 percent. The debt matures on January 1, 2016.

a. Assume that the debt agreement requires Hathaway Manufacturing to make annual interest payments every January 1. Set up a timeline that indicates the timing and magnitude of the future cash ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.