EXERCISES

E12-1

The effects of transactions on shareholders' equity

The following are possible transactions that affect shareholders' equity:

- A company issues common stock above par value for cash.

- A company declares a 3-for-1 stock split.

- A company repurchases 10,000 shares of its own common stock in exchange for cash.

- A company declares and issues a stock dividend. Assume that the fair market value of the stock is greater than the par value.

- A company reissues 1,000 shares of treasury stock for $75 per share. The stock was acquired for $60 per share.

- A company pays a cash dividend that had been declared fifteen days earlier.

- A company generates net income of $250,000.

For each transaction above, indicate the following:

a. The accounts within the shareholders' equity section that would be affected.

b. Whether these accounts would be increased or decreased.

c. The effect (increase, decrease, or no effect) of the transaction on total shareholders' equity.

E12-2

Debt, contributed and earned capital, and the classification of preferred stock

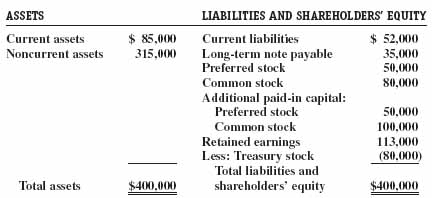

The balance sheet of Lamont Bros. follows:

a. What portions of Lamont's assets were provided by debt, contributed capital, and earned capital? Reduce contributed capital by the cost of the treasury stock.

b. Compute the company's debt/equity ratio. Compute the debt/equity ratio if the preferred stock issuance was classified as a long-term debt. ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.