INCOME STATEMENT CATEGORIES: USEFUL FOR DECISIONS BUT SUBJECTIVE

The income statement classifications discussed in this chapter introduce a very important concept to those who use financial accounting information to predict the future cash flows of an enterprise. The concept is called earnings persistence, and it reflects the extent to which a particular earnings dollar amount can be expected to continue in the future and, thus, generate future cash flows. Earnings amounts with high levels of persistence are expected to continue in the future, while those with low levels of persistence are not. The income statement classifications are useful because, for the most part, they are defined in terms of their persistence. Net operating income is the result of usual and frequent activities that can be expected to continue in the future; “other revenues and expenses” are considered to have somewhat less persistence; and disposals of segments, extraordinary items, and accounting changes are all considered to be “one-shot” events that should not be counted on in the future. Financial statement users cannot ignore these classifications since they contain valuable information about a company's future prospects.

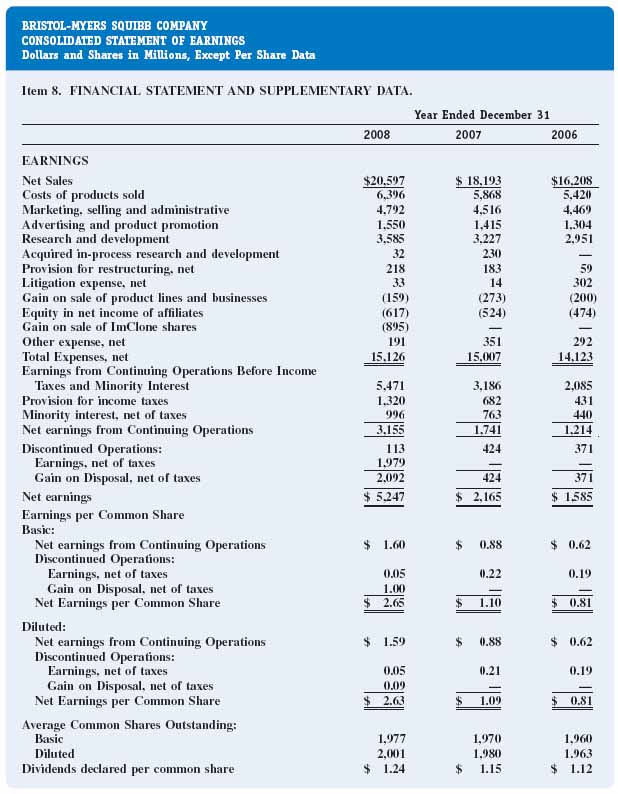

FIGURE 13-6 Financial statements and supplementary data

In terms of the objectives of financial accounting, earnings numbers with high persistence are considered to reflect future cash ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.