Chapter 3 Adjusting the Accounts

Learning Objectives

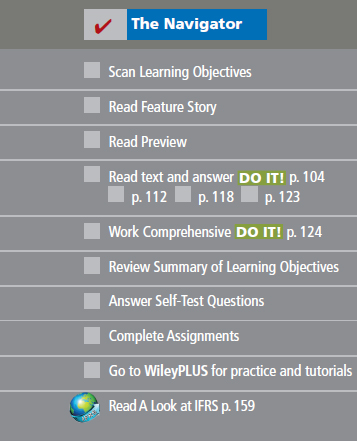

After studying this chapter, you should be able to:

- Explain the time period assumption.

- Explain the accrual basis of accounting.

- Explain the reasons for adjusting entries.

- Identify the major types of adjusting entries.

- Prepare adjusting entries for deferrals.

- Prepare adjusting entries for accruals.

- Describe the nature and purpose of an adjusted trial balance.

![]()

Feature Story

What Was Your Profit?

The accuracy of the financial reporting system depends on answers to a few fundamental questions: At what point has revenue been recognized? At what point is the earnings process complete? When have expenses really been incurred?

During the 1990s, the stock prices of dot-com companies boomed. Most dot-coms earned most of their revenue from selling advertising space on their websites. To boost reported revenue, some dot-coms began swapping website ad space. Company A would put an ad for its website on company B's website, and company B would put an ad for its website on company A's website. No money changed hands, but each company recorded revenue (for the value of the space that it gave the other company on its site). This practice did ...

Get Financial and Managerial Accounting now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.