Chapter 9 Plant Assets, Natural Resources, and Intangible Assets

Learning Objectives

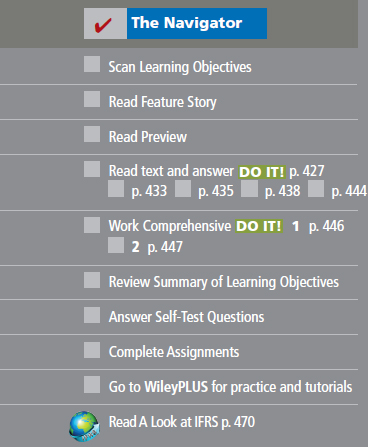

After studying this chapter, you should be able to:

- Describe how the cost principle applies to plant assets.

- Explain the concept of depreciation and how to compute it.

- Distinguish between revenue and capital expenditures, and explain the entries for each.

- Explain how to account for the disposal of a plant asset.

- Compute periodic depletion of natural resources.

- Explain the basic issues related to accounting for intangible assets.

- Indicate how plant assets, natural resources, and intangible assets are reported.

![]()

Feature Story

How Much for a Ride to the Beach?

It's spring break. Your plane has landed, you've finally found your bags, and you're dying to hit the beach—but first you need a “vehicular unit” to get you there. As you turn away from baggage claim, you see a long row of rental agency booths. Many are names you are familiar with—Hertz, Avis, and Budget. But a booth at the far end catches your eye—Rent-A-Wreck. Now there's a company making a clear statement!

Any company that relies on equipment to generate revenues must make decisions about what kind of equipment to buy, how long to keep it, ...

Get Financial and Managerial Accounting now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.