Chapter 14 Financial Statement Analysis

Learning Objectives

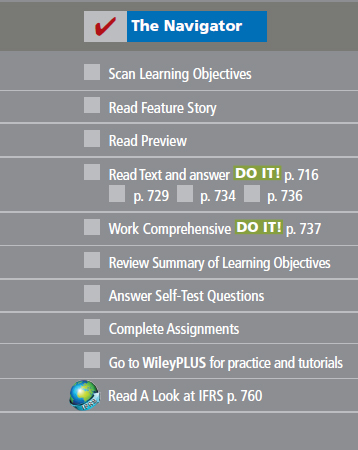

After studying this chapter, you should be able to:

- Discuss the need for comparative analysis.

- Identify the tools of financial statement analysis.

- Explain and apply horizontal analysis.

- Describe and apply vertical analysis.

- Identify and compute ratios used in analyzing a firm's liquidity, profitability, and solvency.

- Understand the concept of earning power, and how irregular items are presented.

- Understand the concept of quality of earnings.

![]()

Feature Story

It Pays to Be Patient

A recent issue of Forbes magazine listed Warren Buffett as the richest person in the world. His estimated wealth was $62 billion, give or take a few million. How much is $62 billion? If you invested $62 billion in an investment earning just 4%, you could spend $6.8 million per day—every day—forever. How did Mr. Buffett amass this wealth? Through careful investing.

However, if you think you might want to follow Mr. Buffett's example and transform your humble nest-egg into a mountain of cash, be warned: His techniques have been widely circulated and emulated, but never practiced with the same degree of success.

Mr. Buffett epitomizes a “value investor.” ...

Get Financial and Managerial Accounting now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.