CHAPTER THREE

The Fed and Interest Rates

FOLLOWING A FEDERAL OPEN MARKET Committee (FOMC) meeting, it is very common for newscasters to report something like, “The Federal Reserve lowered the fed funds interest rate today in an effort to stimulate the lagging economy.” Although it's a great sound bite, in truth, there are a number of things wrong with this statement.

First, the Fed does not set the fed funds rate. The fed funds rate is a marketdetermined rate negotiated between borrowers and lenders in the fed funds market. The fed funds rate is the rate that banks charge to lend overnight funds to one another. The reason the newscaster may have made the statement is that the Fed, through open-market operations, is able to expand or contract the total reserves in the banking system, which in the short term, has an impact on the fed funds rate and other interest rates in the economy. However, on any given day there are many factors that affect interest rates. For the Fed to lower interest rates, it may have to persist in injecting additional reserves into the banking system.

Second, the only interest rate the Fed can set is the discount rate, which is the interest rate that the Fed charges banks that want to borrow from the Fed. The discount rate is often lowered (or raised) to signal the Fed's intent for monetary policy.

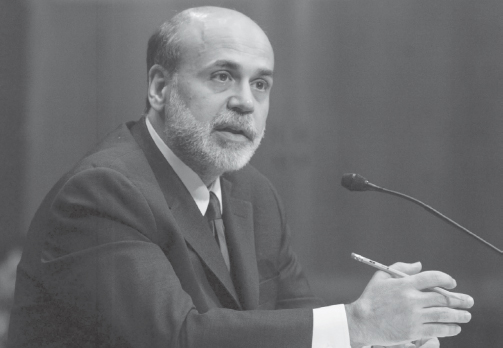

In October 2005, Dr. Benjamin S. Bernanke succeeded the ...

Get Financial Institutions, Markets, and Money, Eleventh Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.