CHAPTER 4 Consumer Protection Laws

John E. Grable, PhD, CFP®

University of Georgia

Sonya L. Britt, PhD, CFP®

Kansas State University

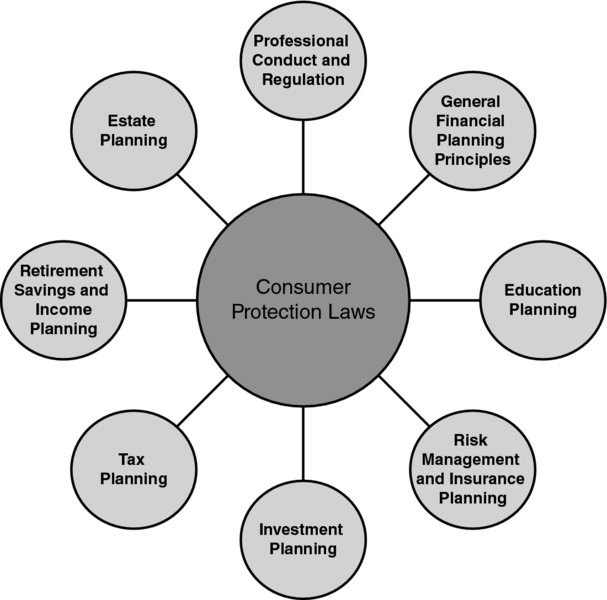

CONNECTIONS DIAGRAM

Consumer protection laws, a combination of federal, state, and local regulations, impact every aspect of financial planning. These laws, in conjunction with the work of consumer advocacy groups, exist to empower consumers in the marketplace. Policies and rules also help guide how financial planning is delivered either as a service or as a product at the household level. Each law provides consumers with legal protections to combat fraud, misrepresentation, discrimination, and illegal behavior on the part of producers and service providers. When combined, these laws, rules, and regulations work to provide a safety net of consumer finance protection.

INTRODUCTION

The United States has a long and lively history related to consumerism, which is defined as the notion that goods and services help explain the role of individuals in society.1 At the outset of the Industrial Revolution, interactions between producers and consumers were dictated by the concept of caveat emptor, which means “may the buyer beware.” Problems associated with a marketplace in which consumers undertake non-regulated risks when making financial products and other financial decisions include lack of choice, lack of information, lack of redress to resolve grievances, ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.