CHAPTER 21 Analysis and Evaluation of Risk Exposures

Dave Yeske, DBA, CFP®

Golden Gate University

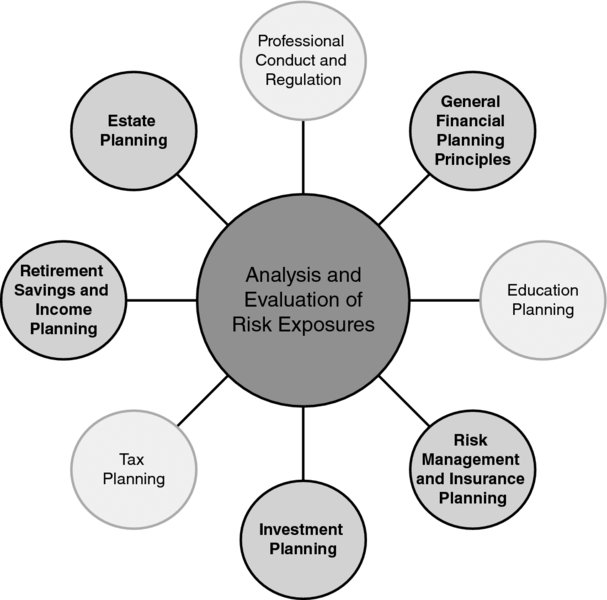

CONNECTIONS DIAGRAM

When evaluating risk exposures, it is important to understand cash flow needs and cash reserves (general principles); the structure, liquidity, and marketability of invested assets (investment planning); retirement assets and cash benefits (retirement planning); and the needs of financial dependents (estate planning).

INTRODUCTION

Every client faces the risk of financial loss, the nature and magnitude of which will vary based on his or her individual circumstances. Such losses might arise from damage to the client’s property, liability for damage to the property of others, and loss of income due to disability or premature death, among many other causes. These losses hold the potential to both degrade current lifestyle and negatively impact the attainment of future family goals. Analyzing and evaluating these risk exposures is the necessary first step financial planners must take in developing recommendations for mitigating or eliminating the potential for loss.

To be of interest to the financial planner, a risk must be both non-trivial and of consequence to the client or client’s family. For example, while loss of earnings due to disability would be a relevant risk for any client who depended on earned income to maintain his or her lifestyle, loss of earnings ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.