CHAPTER 30 Property and Casualty Insurance

Derek R. Lawson, MS

Sonas Financial Group, Inc.Kansas State University

Sarah D. Asebedo, MS, CFP®

Virginia Tech

Martin C. Seay, PhD, CFP®

Kansas State University

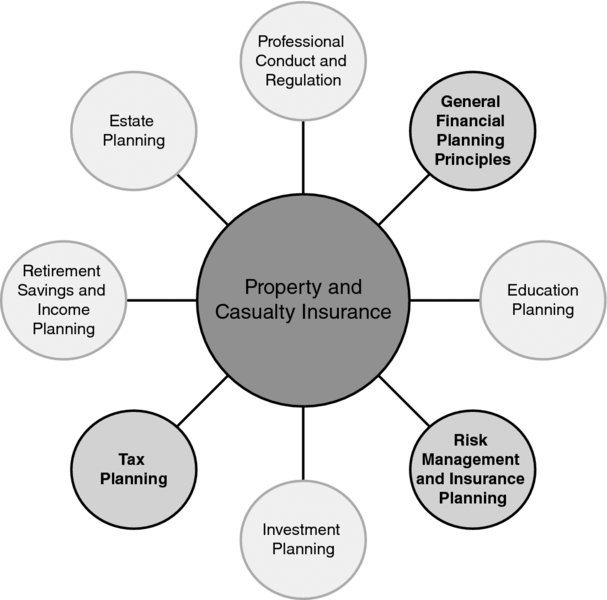

CONNECTIONS DIAGRAM

Property and casualty insurance planning is critical for clients, as it is relevant to many different client assets and situations. For example, property and casualty insurance is necessary if a client owns a car, rents or owns a home, owns a small business, is involved on a professional board, or simply needs personal liability protection. Consequently, property and casualty insurance concepts are firmly rooted in General Financial Planning Principles, with their overall content domain in Risk Management and Insurance Planning. Additionally, given its application to small business owners, an understanding of personal liability associated with business entities, a subcomponent of Tax Planning, is required.

INTRODUCTION

Property and casualty insurance is a vital component of almost any client’s financial plan. Planners must analyze client situations to identify areas of potential risk related to the property clients own and the personal and professional activities in which they, and their family members, take part. Although it is only a component of a comprehensive risk management strategy, property and casualty insurance covers a wide array of topics. ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.