CHAPTER 39 Alternative Investments

L. Michael Ladd, CFA, CAIA, CMT, CFP®

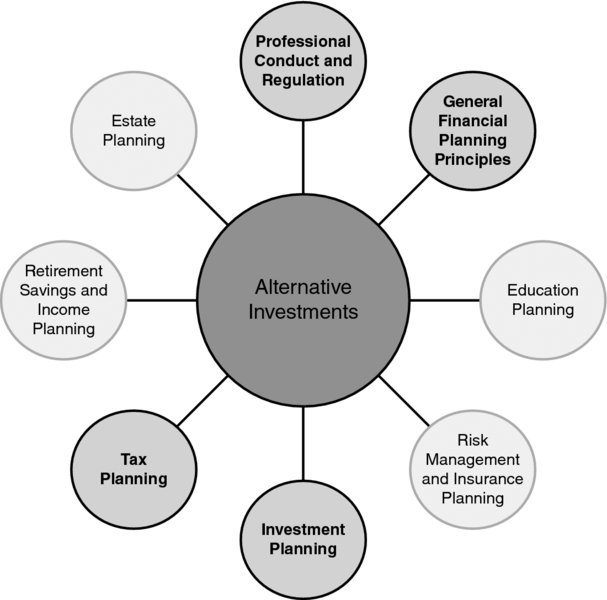

CONNECTIONS DIAGRAM

The success of any investment planning program depends on a number of factors, including the accuracy of mean return forecasts, the closeness of fit between the time horizon of the investor’s goals and those of the investments utilized in the process, and the degree of variability between projected investment returns and true investment outcomes. A reduction in the average variability between the two can lead to an improved client experience. To that end, a comprehensive understanding of all of the investment options available to help achieve a client’s goals is paramount to a planner’s success in serving the client.

INTRODUCTION

In the investment world, just as in the rest of the world, there is a trend towards ever greater complexity. A financial planner who possesses a strong foundation in the various disciplines of traditional investment analysis and who has a broad understanding of traditional investment classes and strategies is afforded an excellent point of reference from which to consider other, alternative investment concepts, assets, and strategies that do not fit neatly into the framework of traditional investment thinking. The greater and broader the knowledge base of the planner and the greater the number of corresponding investment options available to him or her, the ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.