CHAPTER 43 Income Taxation of Trusts and Estates

Martin C. Seay, PhD, CFP®

Kansas State University

Lance Palmer, PhD, CPA, CFP®

University of Georgia

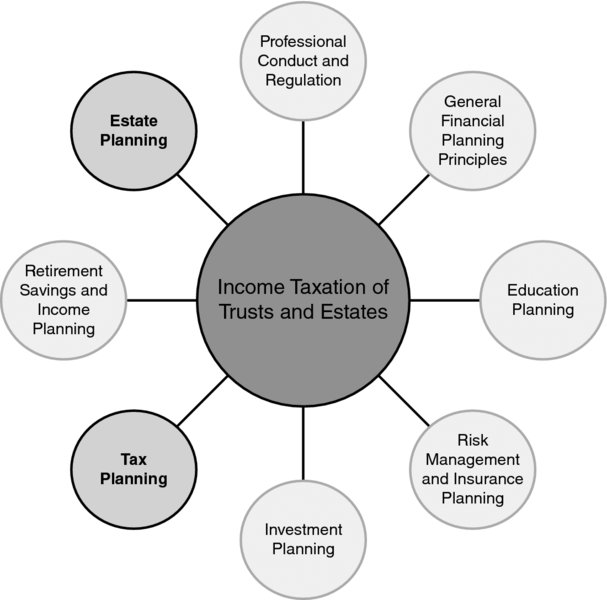

CONNECTIONS DIAGRAM

While the primary focus of this topic is tax planning, concepts learned in this section apply directly to other areas of financial planning. The most direct connection is with estate planning, where an understanding of the income tax consequences of estates and trusts is critical in creating effective and efficient estate plans. Furthermore, the identification of property and investments appropriate for transfer into a trust is greatly informed by understanding the income tax consequences of doing such a transfer.

INTRODUCTION

An understanding of the fundamental structure of the United States Internal Revenue Code as it relates to taxation of trusts and estates is essential for financial planners. This knowledge base is especially critical at three points in the financial planning process: (1) when working with attorneys to create estate planning and trust documents; (2) when reviewing clients’ existing estate planning and trust documents; and (3) when working with a client who is actively engaged with an estate or trust. While the tax code can be rather complex for trusts and estates—making consultation with a CPA or an estate planning lawyer necessary—there are several guiding concepts and principles that ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.