CHAPTER 50 Retirement Needs Analysis

Andrew Head, MA, CFP®

Western Kentucky University

Sharon A. Burns, PhD, CPA (Inactive)

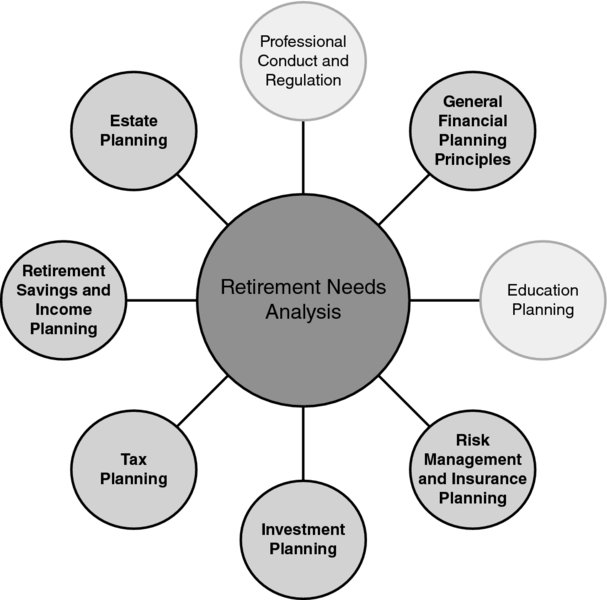

CONNECTIONS DIAGRAM

Six factors are included in a thorough retirement needs analysis. These include income and expense needs, rates of inflation, returns on investments, taxes, number of years before retirement, and life expectancy after retirement. A planner who conducts a retirement analysis for a married couple must also understand estate planning and how the death of one partner affects the seven factors for the second-to-die spouse. Of course, insurance and risk management will affect the cost of living as well as estate plans.

INTRODUCTION

While seven factors are included in a mathematical analysis of retirement, a client’s satisfaction with retirement is most greatly correlated with meeting the personal objectives for retirement. These goals vary among clients. Some wish to travel extensively, whereas others want to relax at home. Hobbies such as golf can be more expensive than reading or watching a movie. Retirees who expect to live longer may experience greater health care expenses. A good retirement analysis begins with an honest examination of expected retirement lifestyle and estimated life expectancy. In addition, each of the retirement analysis factors should be explored in detail with the client.

The lifestyle decision drives the retirement ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.