CHAPTER 63 Estate Planning Documents

Andrew Head, MA, CFP®

Western Kentucky University

Sharon A. Burns, PhD, CPA (Inactive)

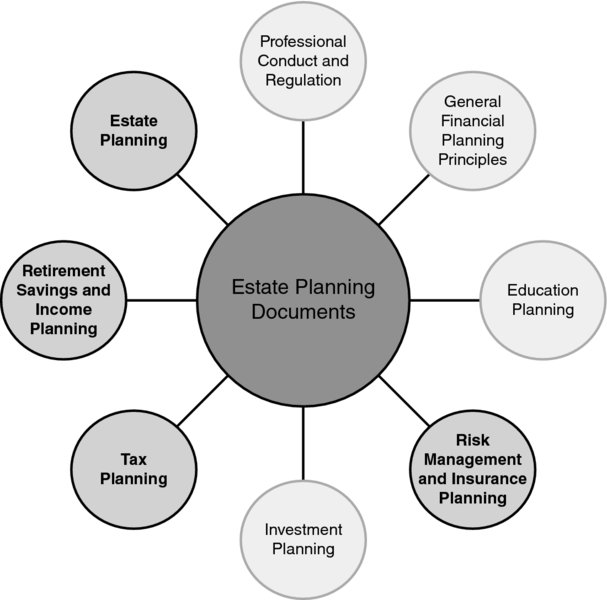

CONNECTIONS DIAGRAM

The primary estate planning documents are wills, trusts, general and health care powers of attorney, and advance medical directives. While the main purpose for obtaining these documents is to have a plan for the distribution or management of one’s estate in the event of death or incapacity, it is worth noting that an estate plan may encompass all areas of financial planning. It should also be pointed out that while insurance and retirement beneficiary forms are not considered estate planning documents in the strictest sense, these documents certainly affect the distribution of insurance and retirement plan benefits upon death as well. A decedent’s property typically generates some income before it is distributed to heirs, and the financial planner must be knowledgeable about the income taxation of estates and trusts. Furthermore, it is important to be aware of what any estate, gift, or generation-skipping transfer tax implications might be for any of the aforementioned documents.

INTRODUCTION

Every person, with few exceptions, owns property that will be distributed to survivors upon his or her death. Two legal documents are designed specifically for the purpose of affecting the transfer of property upon the death of an individual. ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.