CHAPTER 66 Types, Features, and Taxation of Trusts

Elissa Buie, MBA, CFP®

Golden Gate University

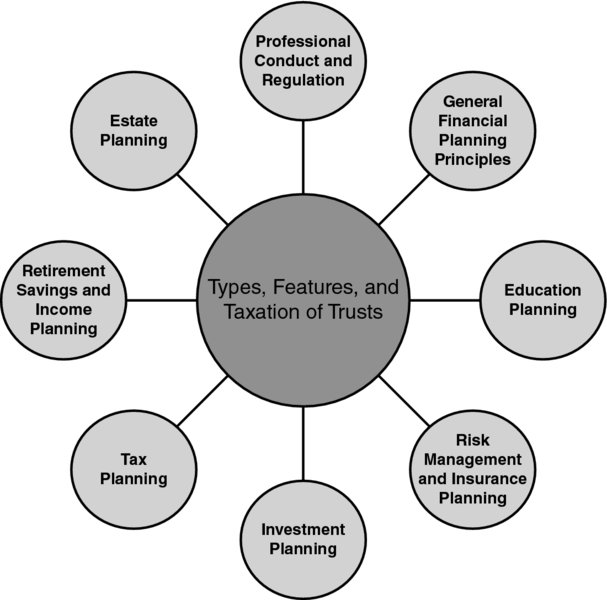

CONNECTIONS DIAGRAM

Trusts and their treatment are complex and connect with virtually every aspect of financial planning. Trusts can be used for risk management and often incorporate insurance policies. Trusts receive, purchase, and sell investments, making aspects of investment planning integral to using trusts. There are important income tax ramifications for the use of trusts. How the use of assets within trust planning impacts a client’s situation is important to understand within the client’s retirement planning as well as estate planning. The use of trusts is a complex topic, requiring excellent communication skills on the part of the financial planner. Also, any strategic analysis of the use of trusts requires working alongside other professionals, such as estate planning attorneys, tax preparers, and insurance agents. Good interpersonal communication will facilitate the work of the group of advisors for the benefit of the client. And finally, as with every aspect of financial planning, the planner must adhere to standards of professional conduct and fiduciary responsibility.

INTRODUCTION

A trust is a legal arrangement, created by a grantor (also called a trustor or settlor), to hold property for the benefit of one or more beneficiaries. The trust has a trustee, who is the ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.