20CAPITAL INVESTMENT DECISIONSIntroduction and Key Concepts

CHAPTER INTRODUCTION

Capital investment decisions (CIDs) are some of the most important business decisions that managers make. Capital decisions are generally defined as relatively large investments that will have an economic life of several years. We will define capital investments broadly, including purchases of equipment, new product development projects, acquiring a product line or a company, and many others. The capital investment decision is a determination of whether the project is likely to create value for shareholders. In this chapter, we will introduce capital investments, evaluation, and key decision criteria, and outline the steps required to evaluate CIDs. In Chapter 21, we will cover advanced topics of CIDs, including dealing with risk and uncertainty, monitoring projects, and presenting capital investment decisions.

THE CAPITAL INVESTMENT PROCESS

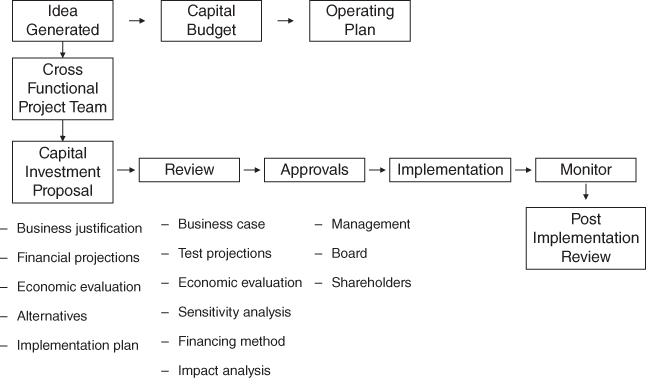

A strong capital investment process is critical to ensure a thorough evaluation and decision. Figure 20.1 outlines key steps in an effective capital investment process.

FIGURE 20.1 Capital Investment Process Overview

Companies should identify potential capital projects as part of their strategic and annual operating planning activities. The capital budget should be an important element of each plan. For strategic plans, the managers should look out ...

Get Financial Planning & Analysis and Performance Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.