12. Analysis Tool #9: Detect Red Flags

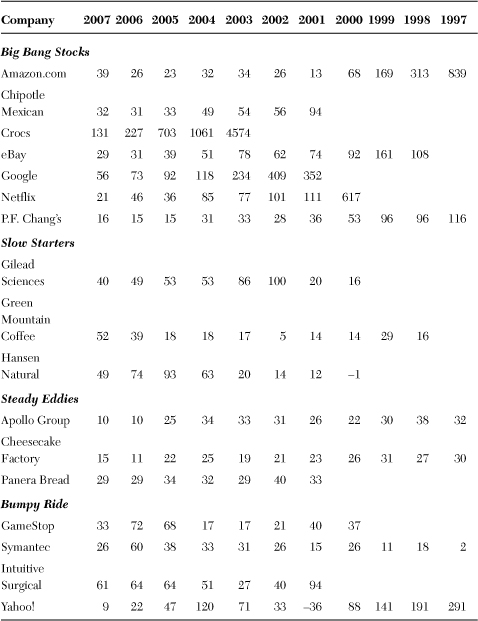

The best growth stock candidates grow sales and earnings at least 15 percent annually, and faster is better. Table 12-1 shows recent year-over-year revenue growth rate trends for a variety of stocks that meet that requirement. I didn’t list 2008 growth rates because in 2008, global economic problems overwhelmed individual company fundamentals.

Table 12-1 Year-Over-Year Revenue Growth Rates

I divided the stocks into four categories:

• Big bang stocks register high double-digit, even triple-digit, year-over-year revenue growth at the start. Of course, those rates are unsustainable, and growth slows quickly. ...

Get Fire Your Stock Analyst!: Analyzing Stocks On Your Own, Second Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.