CHAPTER 9

ONE STEP BINOMIAL TREES

In this chapter we introduce binomial trees. This is a model for interest rates that has three advantages: (1) it is simple, as it does not require high-tech mathematics; (2) when extended to multi-steps, it can be used to price most derivative securities; (3) it is used extensively by practitioners to price real securities. Before we get to this latter part, we must start from basics. We begin the analysis using a specific example, the term structure of interest rates on January 8, 2002.1

9.1 A ONE-STEP INTEREST RATE BINOMIAL TREE

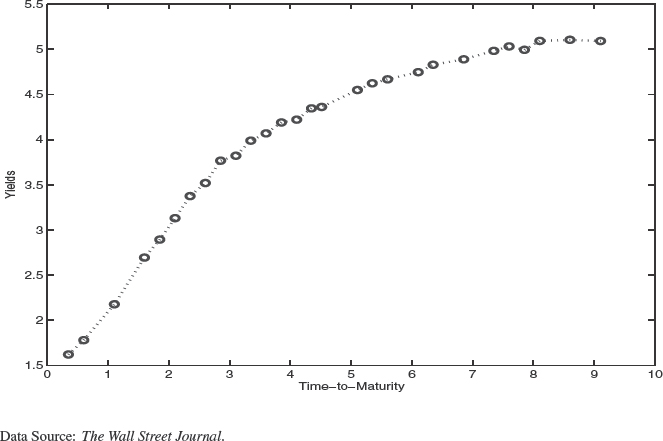

Today is January 8, 2002. The term structure of interest rates is depicted in Figure 9.1. The prices and continously compounded yields of zero coupon bonds (STRIPS) up to T =1.5 to maturity are provided in Table 9.1.

An interest rate model starts with the specification of the dynamics of the short-term interest rate. These dynamics reflect our predictions of future interest rates, as discussed in Chapter 7. We take the short-term interest rate as exogenous, in the sense that it is driven by monetary policy choices, and market participants cannot affect it. In principle, this characteristic is really appropriate for the overnight (Federal funds) rate, but for now we keep matters simple, and we take the 6-month rate as the exogenous rate.

Figure 9.1 Term Structure of Interest Rates on January 8, 2002

Table 9.1 Interpolated ...

Get Fixed Income Securities: Valuation, Risk, and Risk Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.