Chapter 4

Volatility Surface Construction

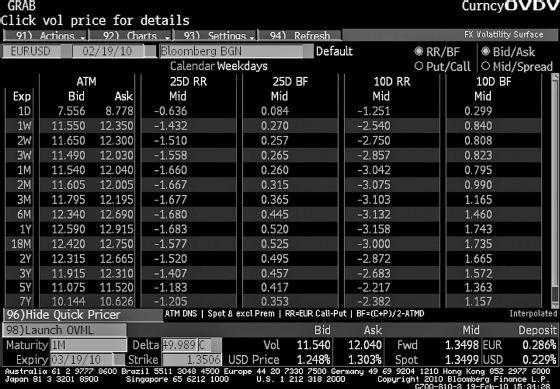

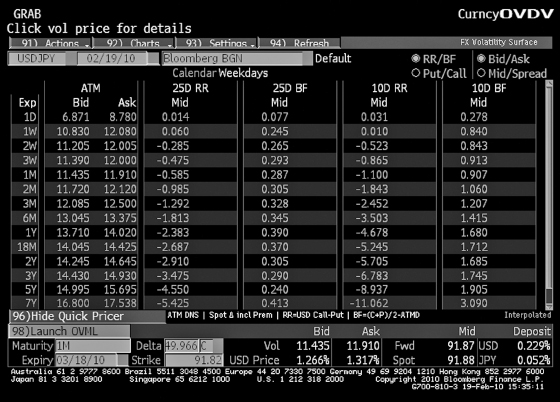

FX markets are particularly liquid at benchmark tenors, such as 1M, 2M, 3M, 6M, 1Y, 2Y and possibly longer dated options. Figures 4.1 and 4.2 show typical market volatility surfaces for EURUSD and USDJPY, obtained by kind permission of Bloomberg Finance L.P.

Figure 4.1 Volatility surface for EURUSD. © 2010 Bloomberg Finance L.P. All rights reserved. Used with permission

Figure 4.2 Volatility surface for USDJPY. © 2010 Bloomberg Finance L.P. All rights reserved. Used with permission

Note that the screenshots provide some information regarding the market conventions used for these currency pairs; for example, premium is included in the delta for USDJPY but not for EURUSD (as we know from Chapter 3). Vol surface representations as provided by various systems may differ, as seen above by use of spot delta out beyond 1Y and the use of the smile strangle not the market strangle (in contrast, this can be toggled on and off in Murex). It is always best to check directly what the smile benchmarks correspond to; the objective of this text is to describe what the various possible modes are.

As well as the liquid benchmark tenors, we need to be able to price options with arbitrary times to expiry, i.e. broken dated options. Even if we confine our ...