CHAPTER 10

REPURCHASE AGREEMENTS AND CERTIFICATES OF DEPOSIT

Repurchase agreements (repos)

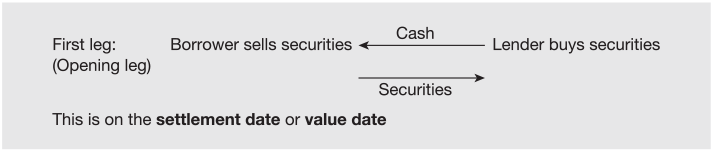

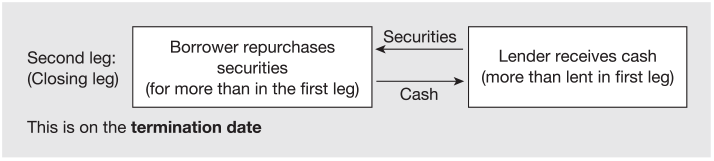

A repo is a way of borrowing large amounts of money for a short time using a sale and repurchase agreement in which securities are sold for cash at an agreed price with a promise to buy them back, or identical ones, at a specified (higher) price at a future date. The interest on the agreement is the difference between the initial sale price and the agreed buy-back.

One, or a few days, later:

Because the agreements provide collateral backup for the ...

Get FT Guide to Bond and Money Markets now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.