CHAPTER TWENTY-SIX

Leasing

INTRODUCTION

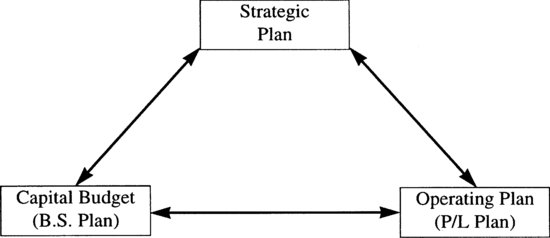

The budgetary process in today’s business environment requires a dutiful coordination of a business strategic plan carefully supported by a capital budget (primarily a balance-sheet–planning tool) and an operating budget (typically an income-statement–planning tool) (see Exhibit 26.1).

Exhibit 26.1 Coordination of Planning Tools

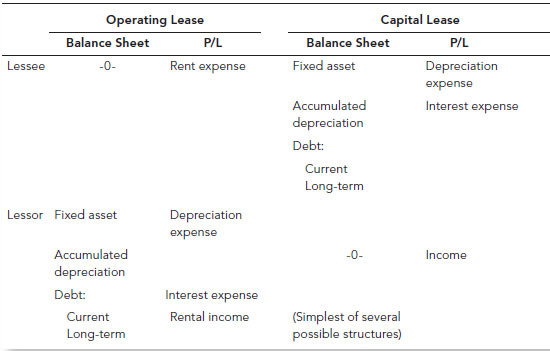

Typically, top management envisions a strategy, and subsequently subordinates are required to project a capital plan (assets, liabilities, and equity) that will enable the company to march toward fulfillment of the strategy vision. Accordingly, a capital budget is prepared, complete with all necessary asset, liability, and equity elements. Frequently, however, the company prefers to avoid balance-sheet implications by electing to lease assets. Thus, off–balance-sheet financing is selected, the balance-sheet impact is minimized, and the operating budget is impacted. To graphically illustrate the financial statement impact, let us examine Exhibit 26.2.

Exhibit 26.2 Impact of Leasing in Financial Statements

From a budgetary viewpoint, it thus becomes evident that leases must be analyzed carefully, in order that the proper budgets become impacted. Occasionally, leasing ...