Chapter 5

CORPORATE ACTIONS

5.1 INTRODUCTION

Administering corporate actions can be one of the more complicated activities undertaken in any investment firm due to the complexities involved in the processing of an event and the varieties of events that can arise.

This chapter will focus on how corporate actions are managed and processed in an investment management firm and consider the range of issues that arise for private investors.

In order to set the context for a detailed review of the types of corporate action, we will look at the general background to the corporate actions industry. We will then investigate how these are managed and processed in a retail investment firm before considering the main types of event in detail.

5.2 CORPORATE ACTIONS INDUSTRY

Corporate actions take place whenever there is a change to the capital structure of a company or organisation that affects the shares or bonds that it has issued.

A corporate action will impact virtually every security at some point and typical well-known examples include dividend payments, rights issues and takeovers. Indeed, it is estimated that nearly a million corporate actions take place every year worldwide.

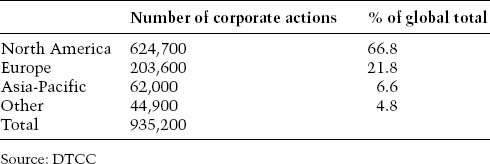

Table 5.1 Number of global corporate actions in 2003–4

The US central depositary, the DTCC, has published data on the number of corporate actions that take place each year. The information that they have provided, ...

Get Handbook of Investment Administration now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.