CHAPTER 17 Pricing Energy Spread Options

Fred Espen BenthHanna Zdanowicz

17.1 SPREAD OPTIONS IN ENERGY MARKETS

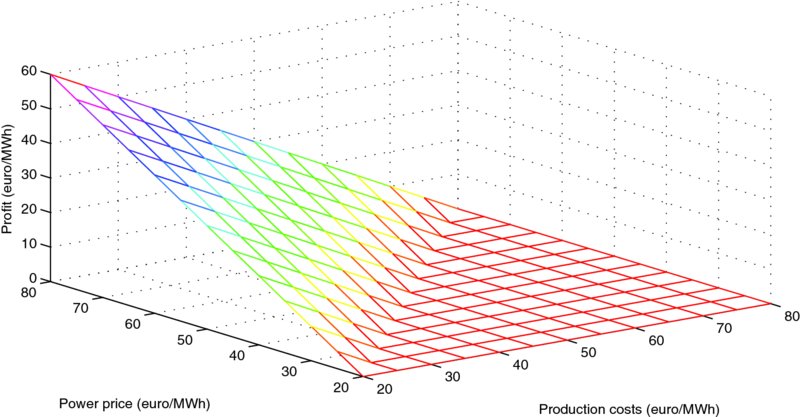

Consider a power producer operating a gas-fired power plant. The producer generates income from selling electricity in the market, at the expense of gas. Simply put, the producer generates electricity only at times when this is profitable, and switches off the plant otherwise. Hence, the producer earns the power price less production costs when this is positive, and nothing otherwise. The production costs will be proportional to the cost of purchasing gas, where the proportionality factor is referred to as the heat rate. The heat rate converts gas into the energy equivalents of power, taking into account also the efficiency of the power plant. In Figure 17.1 we plot the income on a given day for the producer, as a function of power and production costs.

FIGURE 17.1 Profit function from running a gas-fired power plant.

Mathematically, the figure illustrates the function

where P(T) is the price of electricity, G(T) the price of gas at time T and h is the heat rate. Traditionally, gas has been measured in terms of British thermal units (Btu), while power is measured in megawatts (MW). The heat rate converts the energy content of Btu into MW, and multiplies this by ...

Get Handbook of Multi-Commodity Markets and Products: Structuring, Trading and Risk Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.