CHAPTER 18 Asian Options: Payoffs and Pricing Models

Gianluca Fusai, Marina Marena and Giovanni Longo

In this chapter, we describe and compare alternative procedures for pricing Asian options. Asian options are derivatives contracts written on an average price. More precisely, prices of an underlying security (or index) are recorded on a set of dates during the lifetime of the contract. At the option's maturity, a payoff is computed as a deterministic function of an average of these prices. As reported by Falloon and Turner (1999), the first contract linked to an average price was traded in 1987 by Bankers & Trust in Tokyo, hence the attribute ‘Asian’.

Asian options are quite popular among commodity derivative traders and risk managers. This is due to several reasons.

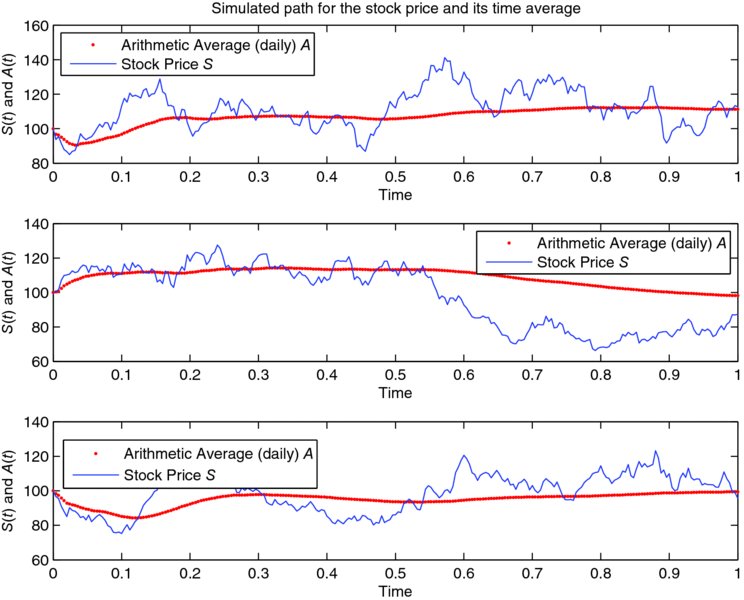

Primarily, Asian options smooth possible market manipulations occurring near the expiry date. In general, the longer the averaging period, the smoother the path. This is shown in Figures 18.1 and 18.2. The first figure shows three simulated paths of the underlying and of its average: the strong oscillations in the underlying path disappear as we consider the time average. The second figure presents simulated paths of the two quantities and the simulated distributions one year in the future: the one that refers to the arithmetic average appears much less dispersed than the one referring to the underlying.

Get Handbook of Multi-Commodity Markets and Products: Structuring, Trading and Risk Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.