Introduction

“An investment in knowledge pays the best interest.”

Benjamin Franklin

It is estimated that there are somewhere between 8,000 and 10,000 hedge funds in existence today. This leads to a number of questions.

- How can we screen through this list to come up with a more manageable universe?

- Why do we hire certain hedge fund managers and not others?

- What factors go into hiring and firing decisions?

- How do we evaluate and assess a portfolio manager's or team's investment edge?

- What are the best questions to ask hedge fund managers in order to get a true sense of their skill set and how they may relate to other investments in your portfolio?

- How can we accurately evaluate hedge fund risk and what kind of information do we need from the funds we hire to effectively monitor changes?

- What are the biggest mistakes often made when analyzing hedge funds and, more importantly, how can we avoid them?

Effective hedge fund analysis requires that we answer these and hundreds of other questions covering all aspects of the hedge fund business including the underlying investment strategy, back office, administration, legal, operations, financial, marketing, client service, transparency, reporting, and so forth.

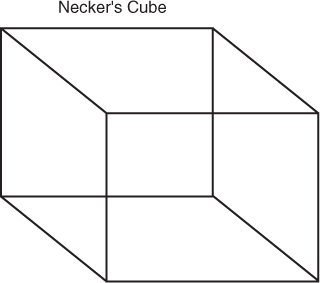

However, the process is dynamic and involves a combination of art and science to efficiently navigate the shifting waters. Have a look at Figure I.1.

Figure I.1 Necker's Cube

Get Hedge Fund Analysis: An In-Depth Guide to Evaluating Return Potential and Assessing Risks now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.