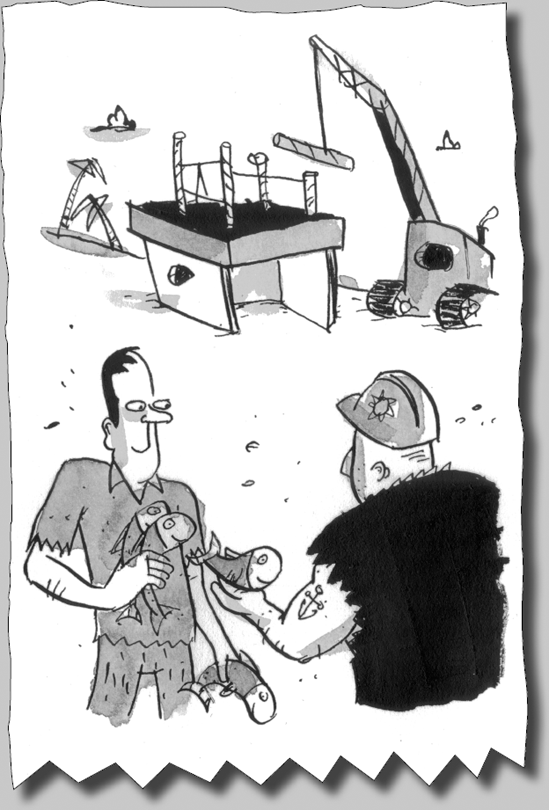

Chapter 14. THE HUT GLUT

Despite the success achieved by Charlie Surfs' switch to the service sector, bank loan officers remained somewhat leery about providing funds for risky service sector businesses. Looking for a safe bet, they soon cast their eyes at the island's sleepy hut loan market, which seemed to offer a good source of low-risk loans.

Up until that point, the hut market had never figured prominently into the overall economic picture. The huts themselves were typically modest affairs well suited to the islanders' tropical lifestyle. But with prosperity growing and interest rates low, demand for newer, bigger and better huts began to emerge.

Traditionally, islanders would save for years, and then pay for a hut up front in full with cold, hard fish. But over time, the bank started making hut loans to the island's more secure borrowers. These loans meant that borrowers did not have to defer their purchases and could buy huts whether or not their savings equaled the purchase price.

Although such lending did not expand the island's productive capacity, or increase the borrower's capacity to repay (as a business loan did), these loans did have good underlying security. That was because, unlike a loan made to an entrepreneur with an unproven business idea, a hut loan came with a piece ...

Get How an Economy Grows and Why it Crashes now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.