CHAPTER 2

Mathematical Algorithms

2.1 INTRODUCTION

In this chapter, we will introduce a non-exhaustive set of numerical algorithms that play an essential part in the course of pricing programs:

- sorting algorithms

- implicit equation solving

- optimization (search for extrema)

- integration

- linear algebra.

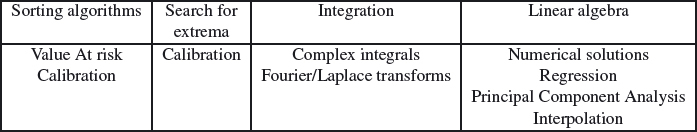

The table below enumerates some of their contributions in quantitative finance:

2.2 SORTING LISTS

Data sorting aims at ordering huge amounts of numerical values recorded in financial databases or sampled by Monte-Carlo trials. In this section, we will introduce two popular sorting algorithms, Shellsort and QuickSort. The reader can refer to Knuth (1998) for more sorting methods.

2.2.1 Shell sort

This method was devised by Donald Shell (1959). The basic idea is to partition a large database into smaller subsets and to sort each separately, before sorting the entire set. The sorting method is called the insertion method, evoking the way a bridge player orders his deck of cards: it is efficient with rather short lists, or already sorted lists when they are placed end to end.

Sorting by insertion This simple algorithm sorts one element of a list at a time. Every element is inserted at the correct position in an already sorted list. We start by sorting the two left-most elements of the list, then insert the third one, and proceed until we obtain the last element.

The VBA procedure ...

Get How to Implement Market Models Using VBA now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.