CHAPTER 9

OPERATING EXPENSES AND PREPAID EXPENSES

Paying Certain Operating Costs before They Are Recorded as Expenses

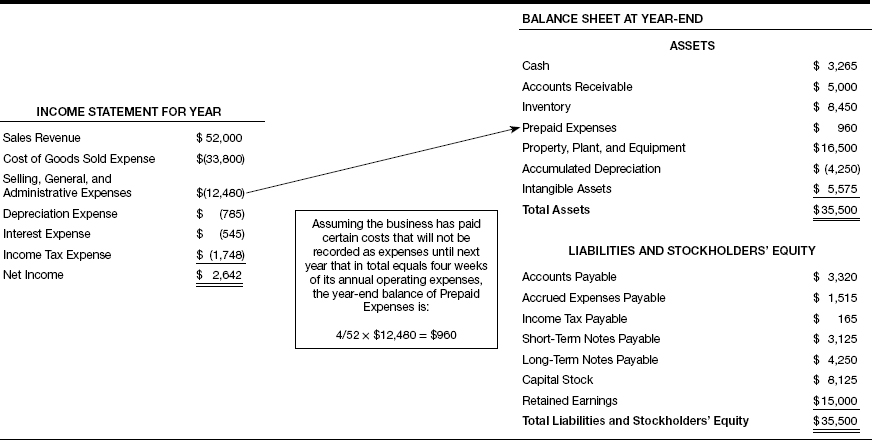

Please refer to Exhibit 9.1 at the start of the chapter, which highlights the connection between selling, general, and administrative expenses in the income statement and the prepaid expenses asset account in the balance sheet. This chapter explains that operating expenses drive this particular asset of a business.

EXHIBIT 9.1—SELLING, GENERAL, AND ADMINISTRATIVE EXPENSES AND PREPAID EXPENSES

Dollar Amounts in Thousands

The preceding chapter explains that some operating expenses are recorded before they are paid—by recording a liability for the unpaid expenses. This chapter, in contrast, explains that certain operating costs are paid before the amounts should be recorded as expenses. In short, businesses have to prepay some of their expenses.

Insurance premiums are one example of prepaid expenses. Insurance premiums are paid in advance of the insurance policy period—which usually extends over 6 or 12 months. Another example is office and computer supplies bought in bulk and then gradually used up over several weeks or months. Annual property taxes may be paid at the start of the tax year; these amounts should be allocated over the future months that benefit from the property taxes.

Cash outlays for prepaid costs are initially recorded not in an expense account but ...

Get How to Read a Financial Report: Wringing Vital Signs Out of the Numbers, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.