CHAPTER 13

NET INCOME AND RETAINED EARNINGS; EARNINGS PER SHARE (EPS)

Net Income into Retained Earnings

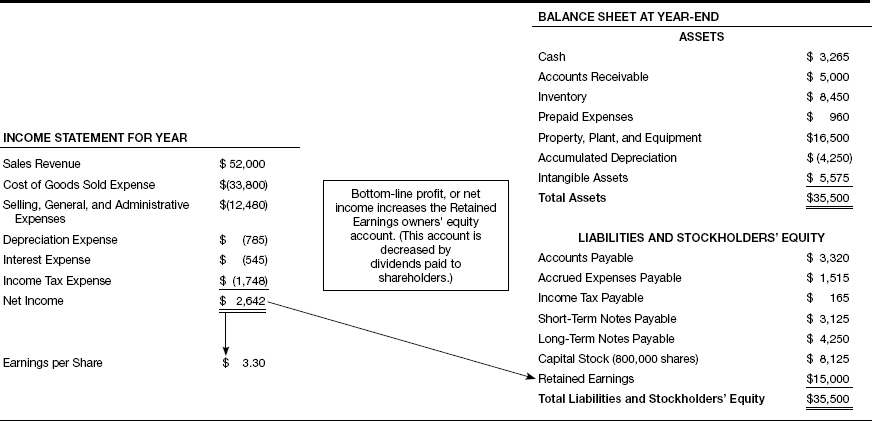

Exhibit 13.1 at the start of the chapter highlights the connection from net income in the income statement to retained earnings in the balance sheet, and from net income to a new piece of information that we show for the first time—earnings per share (EPS). This chapter explains that earning profit increases the retained earnings account. And, we introduce earnings per share (EPS).

EXHIBIT 13.1—NET INCOME AND RETAINED EARNINGS; EARNINGS PER SHARE (EPS)

Dollar Amounts in Thousands

Suppose a business has $10 million total assets and $3 million total liabilities (including both noninterest-bearing operating liabilities such as accounts payable and interest-bearing notes payable). Over the years, its owners invested $4 million capital in the business. Therefore, liabilities plus capital from owners provide a total of $7 million of the company’s total assets. Where did the other $3 million of assets come from?

Assets don’t just drop down like “manna from heaven.” All assets have a source, and one job of accountants is to keep track of the sources of assets of the business. The source of the other $3 million of assets must be from profit the business earned but did not distribute—from retained earnings.

Two basic types of owners’ equity accounts are needed for every business—one for ...

Get How to Read a Financial Report: Wringing Vital Signs Out of the Numbers, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.