CHAPTER 16Risk-Based Performance Management

INTRODUCTION

As we have discussed throughout the book, risk is a bell curve with an expected value, a downside, and an upside. The objective of ERM is to optimize the shape of that bell curve. Risk-based pricing aims to achieve an appropriate return, or expected value, given the underlying risks of the business. A risk appetite statement and related tolerances, risk mitigation strategies, and risk transfer strategies are designed to control downside risks. Finally, strategic risk management is the lever to increase upside opportunity with respect to growth and innovation.

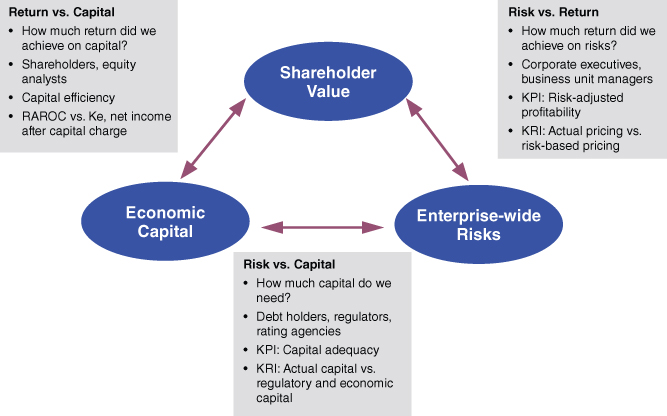

The purpose of this chapter is to discuss risk-based performance management for the key processes to optimize the risk profile and maximize value. Figure 16.1 shows the key relationships between risk, capital, and value creation. Risk-based performance management supports the value creation process by optimizing these interdependent relationships:

FIGURE 16.1 Key Relationships Between Risk, Capital, and Value Creation

- Shareholder value and enterprise-wide risks. How much return did we achieve on risks? Corporate and business leaders are responsible for taking intelligent risks consistent with the company's risk appetite that will produce appropriate returns. Performance (KPI or output metric) is measured by risk-adjusted profitability, whereas as the key driver ...

Get Implementing Enterprise Risk Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.