6.5. SUMMARY

We have described the two major families of portfolio construction models. Rule-based models take a heuristic approach, whereas portfolio optimizers utilize logic rooted in modern portfolio theory. Within each family are numerous techniques and, along with these, numerous challenges. How does the practitioner taking a rule-based approach justify the arbitrariness of the rules he chooses? How does the practitioner utilizing optimization address the myriad issues associated with estimating volatility and correlation? In choosing the "correct" portfolio construction technique, the quant must judge the problems and advantages of each and determine which is most suitable, given the type of alpha, risk, and transaction cost models being used.

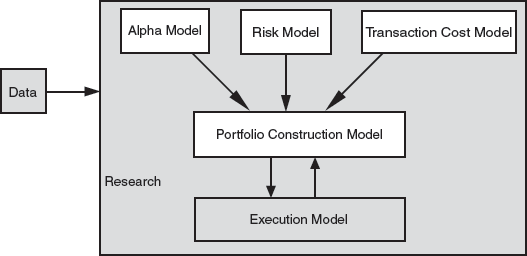

Exhibit 6.5. Schematic of the Black Box

We have completed the penultimate stop on the trip through the inside of the black box, as seen on our roadmap (Exhibit 6.6). Next we will see how quants actually implement the portfolios that they derived using their portfolio construction models.

Get Inside the Black Box: The Simple Truth About Quantitative Trading now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.