Chapter 3The Consistency Problem

Whether cross-sectional option prices are consistent with the time-series properties of the underlying asset returns is probably the most fundamental of tests.

—David S. Bates

Introduction

In the previous chapter, we discussed two different approaches for stochastic volatility parameter estimation: the cross-sectional one where we use a number of options prices for given strike prices (and possibly maturities); and the time-series approach where we use the stock prices over a certain period of time.

One natural question1 would therefore be the following: Will the theoretically invariant portion of the parameter-sets obtained by the two methods be the same?

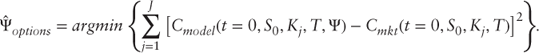

More accurately, supposing we are at time ![]() and we use

and we use ![]() options with strikes

options with strikes ![]() and with maturity

and with maturity ![]() , we have

, we have

The above options could include calls or puts.

On the other hand, during the period ![]() , we can ...

, we can ...

Get Inside Volatility Filtering: Secrets of the Skew, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.