CHAPTER 22 Accounting Changes and Error Analysis

LEARNING OBJECTIVES

After studying this chapter, you should be able to:

- Identify the types of accounting changes.

- Describe the accounting for changes in accounting principles.

- Understand how to account for retrospective accounting changes.

- Understand how to account for impracticable changes.

- Describe the accounting for changes in estimates.

- Identify changes in a reporting entity.

- Describe the accounting for correction of errors.

- Identify economic motives for changing accounting methods.

- Analyze the effect of errors.

In the Dark

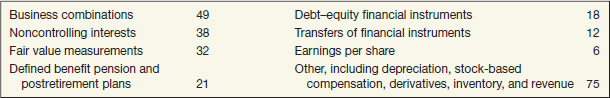

The FASB's conceptual framework describes comparability (including consistency) as one of the qualitative characteristics that contribute to the usefulness of accounting information. Unfortunately, companies are finding it difficult to maintain comparability and consistency due to the numerous changes in accounting principles mandated by the FASB. In addition, a number of companies have faced restatements due to errors in their financial statements. For example, the table below shows types and numbers of recent accounting changes.

Although the percentage of companies reporting material changes or errors is small, readers of financial statements still must be careful. The reason: The amounts in the financial statements may have changed due to changing accounting principles and/or restatements. The chart ...

Get Intermediate Accounting, 15th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.