LEARNING OBJECTIVES

After studying this chapter, you should be able to:

- 1 Understand the uses and limitations of an income statement.

- 2 Understand the content and format of the income statement.

- 3 Prepare an income statement.

- 4 Explain how to report items in the income statement.

- 5 Identify where to report earnings per share information.

- 6 Explain intraperiod tax allocation.

- 7 Understand the reporting of accounting changes and errors.

- 8 Prepare a retained earnings statement.

- 9 Explain how to report other comprehensive income.

Financial Statements Are Changing

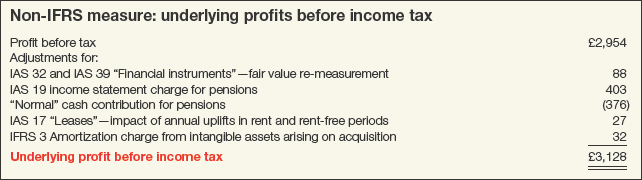

Tesco Group (GBR) recently presented the following additional supplemental information in its income statement.

The directors of Tesco commented in their report to shareholders that they believe the “Underlying profit before income tax” provides additional useful information to shareholders on company trends and performance. They note that these measures are used for internal performance analysis and that underlying profit as defined by IFRS may not be directly comparable with other companies' adjusted profit measures (sometimes referred to as pro forma measures). In addition, they state that it is not intended to be a substitute for, or superior to, IFRS measurements of profit.

Why do companies make these additional adjustments? ...

Get Intermediate Accounting: IFRS Edition, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.