LEARNING OBJECTIVES

After studying this chapter, you should be able to:

- 1 Describe the purpose of the statement of cash flows.

- 2 Identify the major classifications of cash flows.

- 3 Prepare a statement of cash flows.

- 4 Differentiate between net income and net cash flow from operating activities.

- 5 Determine net cash flows from investing and financing activities.

- 6 Identify sources of information for a statement of cash flows.

- 7 Contrast the direct and indirect methods of calculating net cash flow from operating activities.

- 8 Discuss special problems in preparing a statement of cash flows.

- 9 Explain the use of a worksheet in preparing a statement of cash flows.

Show Me the Money!

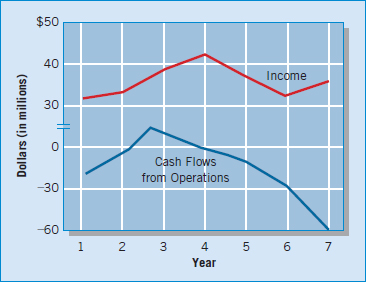

Investors usually look to net income as a key indicator of a company's financial health and future prospects. The following graph shows the net income of one company over a seven-year period.

The company showed a pattern of consistent profitability and even some periods of income growth. Between years 1 and 4, net income for this company grew by 32 percent, from $31 million to $41 million. Would you expect its profitability to continue? The company had consistently paid dividends and interest. Would you expect it to continue to do so? Investors answered these questions by buying the company's shares. Eighteen ...

Get Intermediate Accounting: IFRS Edition, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.