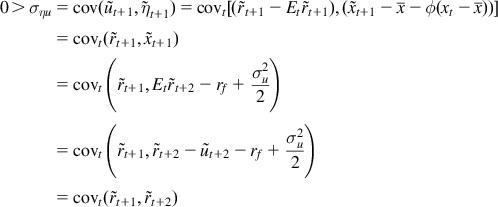

The xt random variable thus moves slowly (depending on ϕ), with a tendency to return to its mean value. Lastly, mean reversion is captured by assuming cov(ηt+1, ut+1)=σηu<0, which translates, as per below, into a statement about risky return autocorrelations:

a high return today reduces expected returns next period. Thus,

in contrast to the independence case. More generally, for all horizons k,

Get Intermediate Financial Theory, 3rd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.