Chapter LE13. LEARNING EXTENSION 13: Federal Income Taxation

In addition to financing and risk factors, income tax liabilities also may differ for each form of business organization selected. Income from partnerships and proprietorships is combined with other personal income for tax purposes. We show the 2010 rate schedules for (1) a married couple filing jointly and (2) a single person.

FILING STATUS | TAXABLE INCOME | MARGINAL TAX RATE |

|---|---|---|

Married Filing Jointly | $0–16,750 | 10% |

16,750–68,000 | 15 | |

68,000–137,300 | 25 | |

137,300–209,250 | 28 | |

209,250–373,650 | 33 | |

Over 373,650 | 35 | |

Single | $0–8,375 | 10% |

8,375–34,000 | 15 | |

34,000–82,400 | 25 | |

82,400–171,850 | 28 | |

171,850–373,650 | 33 | |

Over 373,650 | 35 |

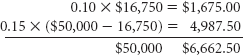

A cursory observation shows that personal income tax rates are progressive tax rates because the higher the income, the larger the percentage of income that must be paid in taxes. For example, let's assume that the taxable income from a proprietorship is $50,000 and that the owner does not have any additional income. If the owner is married and filing a joint return and the spouse has no reportable income, the income will be taxed as follows:

The marginal tax rate is the rate paid on the last dollar of income. In our example it is 15 ...

Get Introduction to Finance: Markets, Investments, and Financial Management, Fourteenth Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.