APPENDIX H

Presale: ACG Trust III

| Publication date: Primary Credit Analyst: Secondary Credit Analysts: | 19-Dec-2005 Anthony Nocera, New York (1) 212-438-1568; anthony_nocera@standardandpoors.com Ted Burbage, New York (1) 212-438-2684; ted_burbage@standardandpoors.com Philip Baggaley, CFA, New York (1) 212-438-7683; philip_baggaley@standardandpoors.com Michael K Vernier, Esq., New York (1) 212-438-6629; michael_vernier@standardandpoors.com |

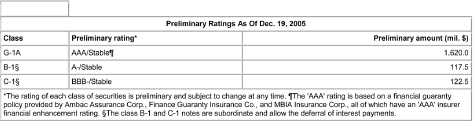

$1.86 Billion Floating-Rate And Deferrable Interest Notes Series 2005-1

This presale report is based on information as of Dec. 19, 2005. The ratings shown are preliminary. This report does not constitute a recommendation to buy, hold, or sell securities. Subsequent information may result in the assignment of final ratings that differ from the preliminary ratings.

Profile

Expected closing date: Dec. 29, 2005.

Collateral: Shares in entities that directly and indirectly receive lease and residual cash flows associated with a portfolio of aircraft.

Underwriters: UBS Investment Bank and Deutsche Bank.

Seller and remarketing and administrative agent: Aviation Capital Group Corp.

Statutory trustee: Wells Fargo Delaware Trust Co.

Monitoring agent: Aircraft Monitoring Services LLC.

Servicing agent and cash manager: Pacific Life Insurance Co. (AA/Stable/A-1+). ...

Get Introduction to Structured Finance now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.