APPENDIX J

■ Noteworthy Changes

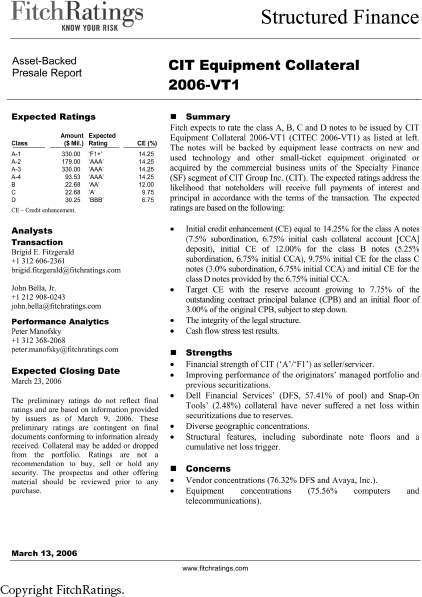

Initial Credit Enhancement

Initial CE levels are lower by 62.5 basis points (bps) for the class A notes, 62.5 bps lower for the class B notes, 87.5 bps lower for the class C notes and 37.5 bps lower for the class D notes versus CITEC 2005-VT1. Lower CE levels are primarily due to performance improvements within the SF managed and securitized portfolios, as well as the higher concentration of DFS assets, the best performing origination source on a net basis.

CCA Step-Down Feature

At close, the CITEC 2006-VT1 CCA will be initially funded at 6.75% of the original CPB and, thereafter, targeted at 7.75% of the outstanding CPB. The initial CCA level is a 37.5 bps reduction versus the CITEC 2005-VT1 initial funding of 7.125%. Meanwhile, the targeted 7.75%, and 3.00% CCA floor (prior to step-down) remain consistent with the prior transaction.

New to the 2006-VT1 structure is the CCA stepdown. This feature enables the CCA to step down by 0.25%/0.25%/0.25%, respectively, on three specific payment dates if the transaction performs within predetermined performance metrics (see page 5).

Parties to Transaction

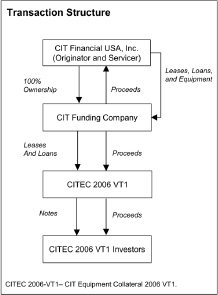

Issuer: CIT Equipment Collateral 2006-VT1

Indenture Trustee: Bank of New York

Servicer: CIT Financial USA, Inc.

Tighter Sequential Trigger Levels

Similar ...

Get Introduction to Structured Finance now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.