CHAPTER TWO

Overconfidence

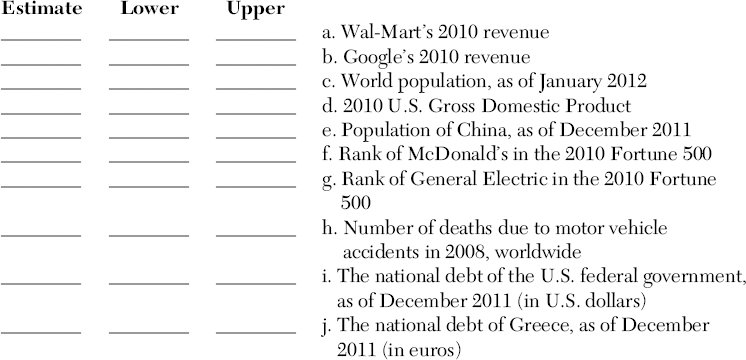

To begin this chapter, we are going to test your knowledge. Ten quantities appear below. Do not look up any information about these items. For each, write down your best estimate. Next, put a lower and upper bound around your estimate, so that you are 98 percent confident that your range surrounds the actual quantity. Make your range wide enough that there is a 98 percent chance the truth lies inside it.

The answers will appear later in the chapter. First we need to explain why we asked you these questions and what this test demonstrates. For now, let's just say that it illustrates overprecision in judgment and that overprecision is one form of overconfidence.

THE MOTHER OF ALL BIASES

Overconfidence may be the mother of all biases. We mean this in two ways. First, overconfidence effects are some of the most potent, pervasive, and pernicious of any of the biases we document in this book. Griffin and Varey (1996) write that “overconfidence is not only marked but nearly universal.” The bias is “the most robust finding in the psychology of judgment,” according to DeBondt and Thaler (1995). Overconfidence has been blamed for wars, stock market bubbles, strikes, unnecessary lawsuits, high rates of entrepreneurial bankruptcy, and the failure of corporate mergers and acquisitions. It could also explain the excessively high rate of trading in the stock market, ...

Get Judgment in Managerial Decision Making, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.