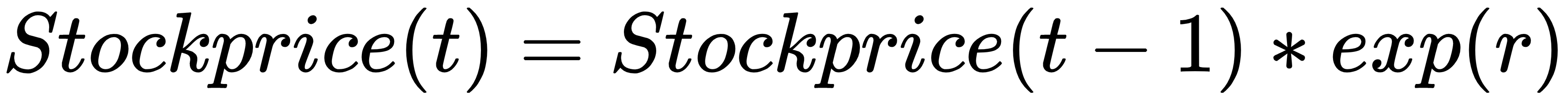

The daily price of an asset is obtained as an exponential raise of the previous day's price using a certain value: r. The r is a periodic rate of return. So, we can say that the asset increases or decreases in a day according to the following formula:

The exponential term is called daily return. Since the rate of return of an asset is a random number, to model the movement and determine possible future values, we must use a formula that shapes random movement. This model was formulated by Louis Bachelier. His work has been expanded and has eventually become fundamental in many areas of finance, hence the BSM formula. ...