CHAPTER 17

Paid-in-Kind Securities

Paid-in-kind (PIK) securities are securities in which interest payments are paid in additional securities instead of cash. At the end of the period the balance of debt increases in lieu of making interest payments in cash. Typically that increase in the balance also incurs additional interest; thus there is interest on interest. This is typically a more expensive type of security, but does less to strain the company’s immediate cash flow. PIK interest securities have become quite popular in recent years, so I felt it important to touch upon, even if it’s not core to the Heinz case.

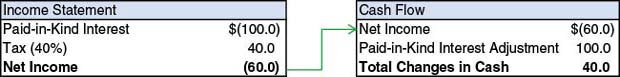

Let’s take an example to illustrate the flows of a paid-in-kind security. If we have an outstanding debt of $1, 000 with 10 percent PIK interest, then at the end of the period, we incur a $100 PIK interest expense. If we assume a 40 percent tax rate, the net-of-tax amount, ‘$60, will flow into the cash flow statement. See Table 17.1.

TABLE 17.1 Paid-in-Kind Interest Expense

Since the PIK interest expense is a noncash expense (it is actually not paid in cash), it is added back in the cash flow statement. Thus, the only effect to cash is the tax savings.Table 17.2 shows that the PIK interest accumulates as a liability on the balance sheet.

TABLE 17.2 Paid-in-Kind Interest Cash Flow and Balance Sheet Effects

This balances because the cash adjustment of $40 less the $100 ...

Get Leveraged Buyouts: A Practical Guide to Investment Banking and Private Equity, + Website now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.