CHAPTER 1 The Global M&A Market: Current Status and Evolution

This chapter reviews the global merger and acquisition (M&A) market and traces its expansion. Transactions are segmented into several categories, with most deals being medium-sized, private transactions. There is no guarantee of success in acquisitions.

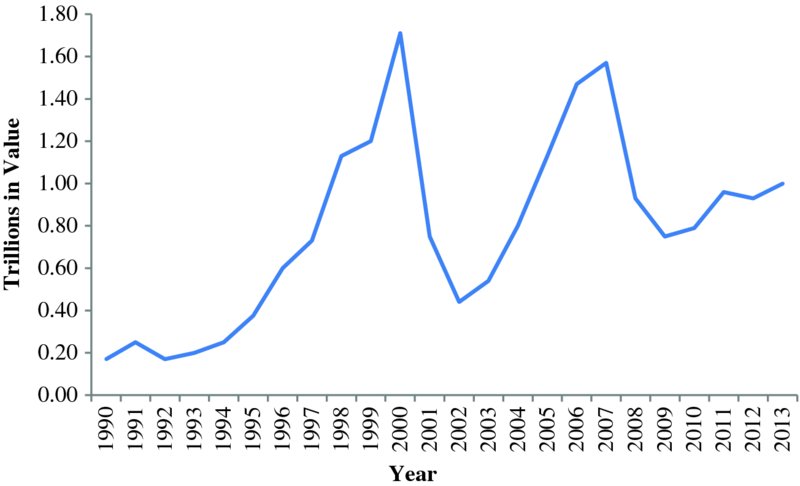

An Upward Trend, Interrupted by Booms and Busts

M&A activity over the past 20 years has shown a marked growth trend, interrupted by peaks and valleys related to financial booms and busts. Volume spiked during the Internet bubble (1998–1999) and the private equity boom (2006–2007), only to drop significantly and then recover. Announced deals in the United States in 2013 totaled $1.1 trillion in volume, encompassing over 15,000 transactions. Figure 1.1 shows the trend line.

Figure 1.1 M&A Activity, 1993–2013, by Value in the United States.

Data Source: Bloomberg and Reuters

As the figure shows, the M&A market is a cyclical business. Activity is tied to several variables:

- Stock market valuations

- Availability of debt financing

- Optimistic views on the economy

When equity values rise in the stock market, an acquirer can offer his inflated stock to a seller as currency for the transaction. Using high-priced stock in a deal makes the transaction’s mathematics more attractive for the buyer. Alternatively, if the seller doesn’t want the buyer’s stock, the buyer can ...

Get M&A: A Practical Guide to Doing the Deal, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.