Chapter 18

The Role of the CIO in Mergers, Acquisitions, and Divestitures

The Double-Duty Role

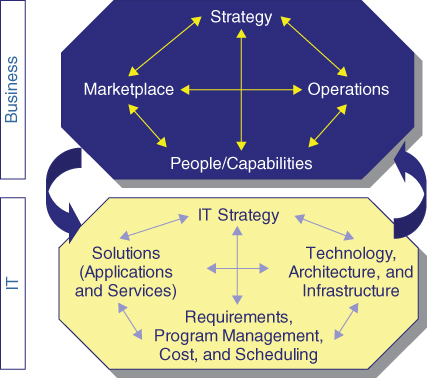

The CIO takes on two separate roles during significant M&A activity. While the rest of the C-suite is concentrating on combining organizations and building a future strategy for their own business functions, the CIOs, Janus-like, must face both inward to their own function and at the same time outward to accommodate all the changes their own customers demand. In most organizations, the setup of IT inside its parent organization helps it execute as if it were a company within a company (see Exhibit 18.1). If the size of the parent company is significant, the IT organization's own internal considerations and functions for combining strategy and planning, human resources (HR), real estate, finance, procurement and customer relations, and the like represent a merger within a merger of its own. The CIO will need to duplicate the approach to, and execution of, the overall organization's M&A activities, often with a shortened timeframe so that IT is ready when Day 1 lands.

Exhibit 18.1 Company-within-a-Company Model

While attending to what amounts to a significant and multifaceted merger of their own, CIOs generally need to lead and direct the role of IT to accommodate the often-changing and ill-defined requirements coming from the organization's overall M&A plans and actions. ...

Get M&A Information Technology Best Practices now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.