Chapter 5

Why Volatility Is Not Just about Risk, and the Case of Leveraged ETFs

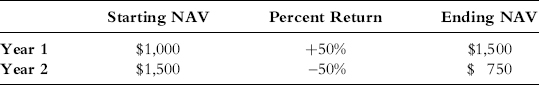

Volatility is normally considered only in the context of risk, where as we have seen, it is often an inadequate and even misleading indicator. Most investors don’t realize that higher volatility also reduces return as well. An equal percentage gain and loss do not result in a breakeven outcome, but rather always imply a net loss—the larger the absolute magnitude of both the gain and loss, the greater the loss. For example, a 50 percent gain in one year and a 50 percent loss in the next (or vice versa) will result in a 25 percent net loss at the end of the two years (see Table 5.1).

Table 5.1The Negative Impact of Volatility on Return

The same average monthly return will result in steadily decreasing compounded returns as volatility increases. Table 5.2 compares five 12-month return streams, each of which has six months of gains and six months of losses, with the gains being 2 percent larger in magnitude. In all five cases, the average monthly return equals 1 percent. In case A, there are six months of 3 percent returns and six months of 1 percent losses (average monthly return equals 1 percent). In this instance, the annual compounded return is moderately higher than the arithmetic return (12.4 percent versus 12.0 percent).1 Although the average monthly return remains the same, the compounded annual ...

Get Market Sense and Nonsense: How the Markets Really Work (and How They Don't) now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.