Chapter 12

Hedge Fund Investing: Perception and Reality

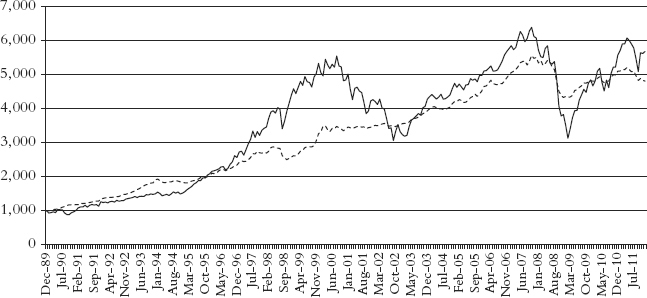

What is a conservative investment? Figure 12.1 shows two investments over a 22-year investment horizon scaled so they are equal at the start of the period. The two series have tracked each other over the long term, with the lead changing several times. As of the end of 2011, the investment represented by the solid line had a modestly higher average annual compounded return of 8.2 percent for the entire period versus 7.4 percent for the investment represented by the dotted line, although as recently as three months earlier the two long-term returns were near equal. Which would you label as the more conservative investment? Choose before reading on.

Figure 12.1 Which Is the Conservative Investment?

Presumably, you picked the dotted line as being more conservative. Congratulations—you have just identified a hedge fund index as being more conservative and, by implication, an equity index as being riskier. The solid line is the S&P 500 Total Return index (that is, including dividends) and the dotted line is the Hedge Fund Research (HFR) Fund of Funds index.1 These lines were deliberately left unlabeled in the chart to assure reader objectivity.

The most striking contrast between the two indexes is in the magnitudes of the equity drawdowns. The S&P 500 Total Return index experienced two periods of massive declines: a 51 percent ...

Get Market Sense and Nonsense: How the Markets Really Work (and How They Don't) now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.